The AI Boom: Opportunity or Bubble? Why Investors Are Turning to Precious Metals

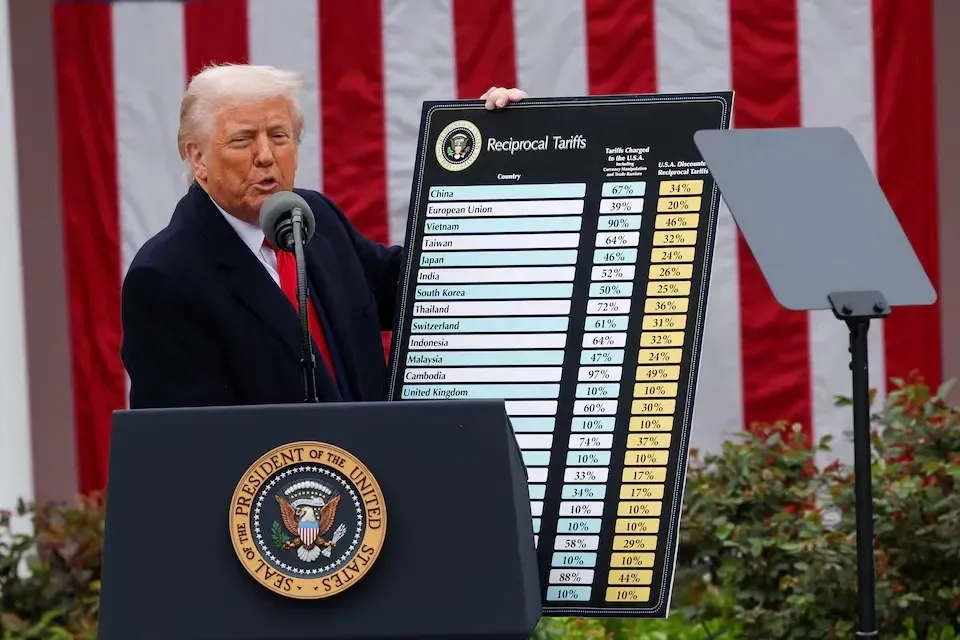

Artificial intelligence is driving a historic surge in U.S. markets. Nvidia has soared to a $4 trillion valuation, now making up more than 7% of the S&P 500. According to Morgan Stanley, AI-linked companies account for an outsized share of stock market gains this year.

But some of the world’s top economists are warning that the AI rally may be less sustainable than it looks. Torsten Sløk, chief economist at Apollo Global Management, recently said the current AI boom could prove even riskier than the dot-com bubble of the early 2000s. The reason? Valuations are skyrocketing while real profits are limited.

A new MIT study supports that concern. Researchers found that 95% of companies investing in AI pilots are not seeing measurable returns. Meanwhile, S&P Global reports that U.S. corporate bankruptcies are at their highest level since the pandemic, with 71 companies filing in a single month. The combination of inflated tech valuations and widespread corporate distress points to a fragile market environment.

What This Means for Investors

When a handful of companies dominate the market, portfolios become vulnerable. If growth expectations for AI stocks falter, investors could face painful drawdowns. The lesson from history is clear: concentration in a single sector magnifies risk.

The Case for Precious Metals

Periods of uncertainty highlight the importance of diversification. Precious metals, especially gold and silver, have consistently acted as safe havens during economic turbulence.

- During the

dot-com crash, gold held its ground while tech collapsed.

- In the

2008 financial crisis, gold surged as equities and real estate plunged.

- Today, as investors grapple with overvaluation, inflation, and rising bankruptcies, gold and silver remain among the most reliable ways to preserve wealth.

Final Takeaway

The AI boom may continue for some time, but its risks are mounting. Investors should balance opportunity with protection. By diversifying into precious metals, you can reduce exposure to market bubbles, safeguard purchasing power, and build long-term financial security.

Sources

- Nvidia’s $4T valuation and AI’s outsized role: Financial Times

- AI boom risk compared to dot‑com bubble (Torsten Sløk, Apollo): Investors

- MIT study:

The GenAI Divide: State of AI in Business 2025 — 95% of AI pilots show no measurable ROI Investors+13Investors+13Medium+13

- Rising corporate bankruptcies at pandemic-level high: Financial Times