SHOP PRODUCTS

MOST POPULAR GOLD PRODUCTS

WHY GOLD STILL MATTERS, THE ENDURING VALUE OF A SAFE-HAVEN ASSET

At Red State Gold Group, we’re often asked, “Why gold?” The answer lies in its timeless role as a safeguard against economic volatility. Gold has a proven track record of holding its value through market downturns, inflation, and currency devaluation, making it a reliable foundation in uncertain times.

Unlike many traditional assets, gold often moves independently of the stock market, serving as a stabilizing force when other investments falter. In that sense, gold isn’t just another asset, it’s like financial insurance for your portfolio.

BUYING GOLD COINS, WHAT YOU SHOULD KNOW

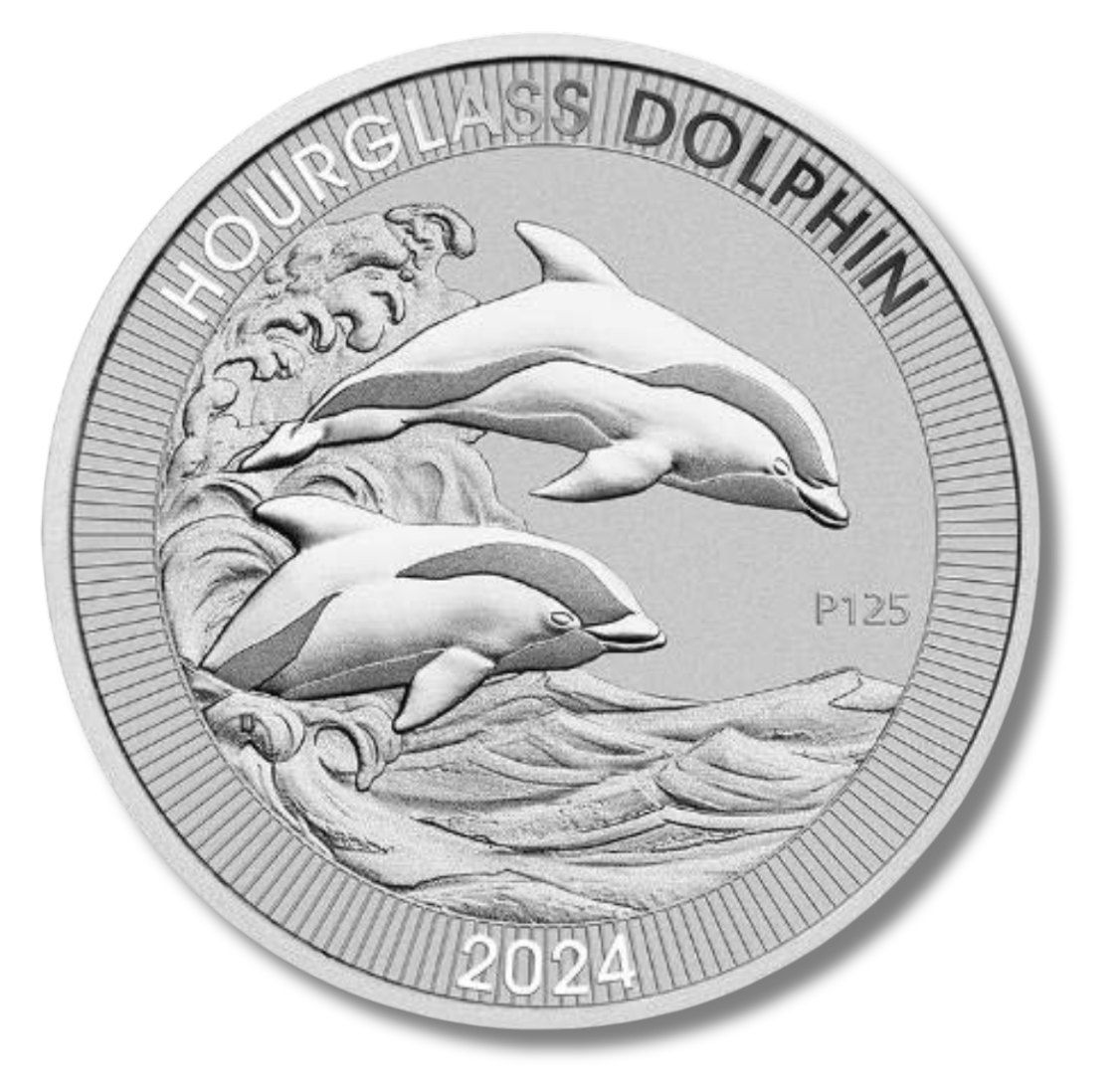

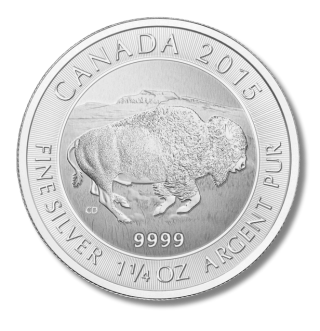

Gold coins remain one of the most trusted and popular ways to own physical gold. Minted by prestigious institutions like the U.S. Mint and Royal Canadian Mint, these coins come in a variety of weights, designs, and levels of collectibility.

Popular coins include the American Gold Eagle, Canadian Maple Leaf, South African Krugerrand, and Australian Kangaroo. While these coins carry legal tender face values in their countries of origin, their actual worth is driven by gold content and market demand, typically far exceeding face value.

WHY GOLD COINS ARE MORE THAN JUST METAL

When you acquire a gold coin, you’re not just adding an asset, you’re preserving history, culture, and long-term value. Each coin design tells a story. These coins become powerful conversation pieces and cherished heirlooms.

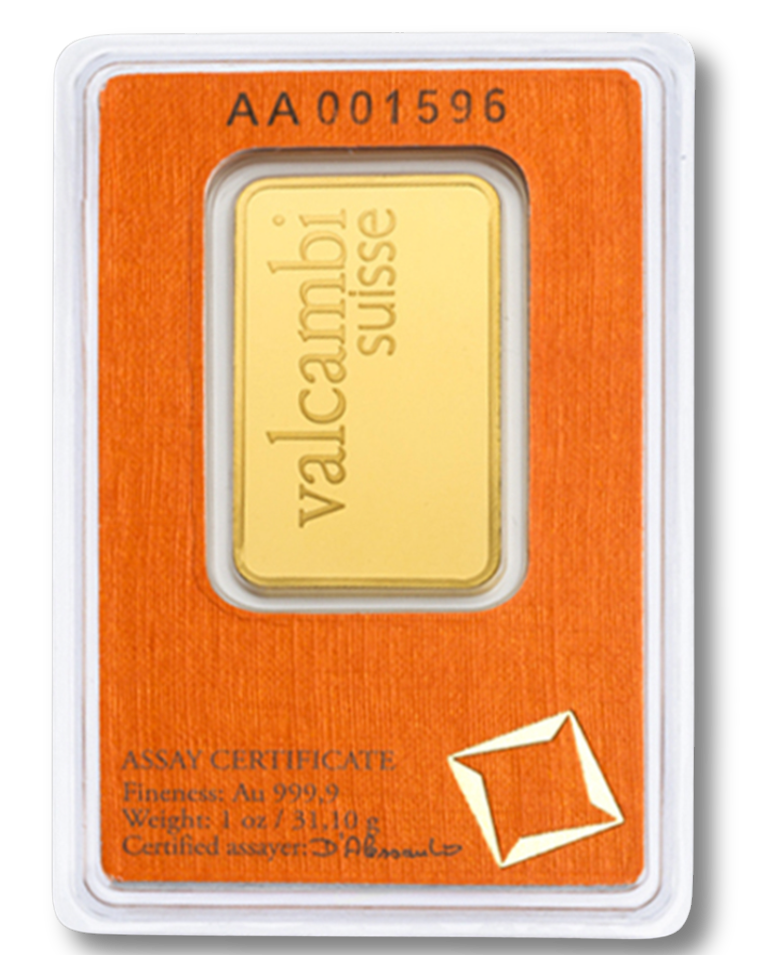

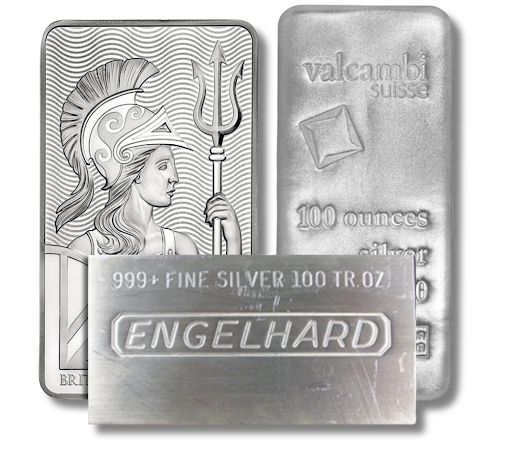

UNDERSTANDING GOLD BARS

Gold bars are an efficient and practical choice for those seeking simple, cost-effective exposure to physical gold. Available in sizes ranging from 1 gram to 1 kilo, gold bars allow investors to scale their holdings according to their goals.

Produced by both government and private mints, notable manufacturers include PAMP Suisse, the Perth Mint, and the Austrian Mint. Each bar is typically stamped with key details such as purity, weight, and a serial number. Many also come with an assay certificate for added assurance.

WHY CHOOSE GOLD BARS?

Gold bars offer a more streamlined way to invest in physical gold. Their minimalist design focuses on weight and purity, which often results in lower premiums compared to coins. If you're looking to accumulate gold efficiently without the added cost of collectible appeal, bars can be a smart choice.

GOLD AND YOUR RETIREMENT, THE GOLD IRA ADVANTAGE

Many investors turn to physical gold as part of a self-directed IRA. These accounts offer the tax benefits of traditional IRAs while adding a layer of security and diversification through tangible assets.

By including IRS-approved gold coins and bars in your retirement portfolio, you’re not only diversifying your holdings, you’re protecting your future with real assets that aren’t tied to the performance of stocks or paper currency.

INVESTING WITH RED STATE GOLD

At Red State Gold Group, we believe in the power of relationships. That’s why we connect every client with a dedicated precious metals specialist who takes the time to understand your goals, answer your questions, and walk you through every step of the process.

Whether you’re acquiring gold for wealth protection, retirement diversification, or legacy planning, our experienced team is here to help you make confident, informed decisions backed by real-time guidance, not algorithms.

FREQUENTLY ASKED QUESTIONS

How do I purchase gold?

Purchasing gold coins is simple with Red State Gold Group. Speak directly with one of our trusted agents who will guide you through available options, payment methods, and secure delivery or IRA placement. We offer personalized service tailored to your needs.

How do central banks influence the gold market?

Central banks are major players in the gold market. By holding gold reserves and engaging in strategic purchases, they reduce reliance on fiat currencies and add stability to national balance sheets. Their activity often signals long-term confidence in gold as a global store of value.

Why is U.S. gold a solid investment?

Coins like the American Gold Eagle and Gold Buffalo are respected worldwide for their purity, craftsmanship, and reliability. Backed by the U.S. Mint, these coins carry global recognition and appeal for long-term investors.

Why is gold considered a safe-haven asset?

Gold has earned its reputation as a safe haven by maintaining value during inflation, geopolitical unrest, and financial downturns. Its intrinsic worth and limited supply make it a powerful tool for wealth preservation.

Can I store gold at home?

Yes. Many clients choose to store their gold at home using secure safes or vaults. We can guide you on best practices, security measures, and insurance considerations. Alternatively, we can help you arrange professional third-party storage for added peace of mind.

Is gold a liquid asset?

Yes, gold is highly liquid. It can be converted into cash through a wide network of dealers and financial institutions. When you’re ready to sell, your dedicated Red State Gold Group agent will help you evaluate your options and ensure a smooth transaction.

PRICE MATCH DISCLAIMER

Our Price Match Guarantee extends to major national competitors offering similar products and services. However, it does not apply to prices listed by local coin shops or online-only retailers. At Red State Gold Group, we provide a personalized, relationship-based experience with dedicated specialists who offer tailored guidance and long-term support—something not typically available through anonymous or transactional platforms. Additionally, our service includes assistance with account setup, ongoing portfolio reviews, and in many cases, coverage of IRA account fees. This comprehensive level of support is factored into our pricing and is designed to offer long-term value beyond the initial purchase.

GET YOUR FREE ULTIMATE WEALTH SURVIVAL KIT

By submitting this form, I agree that Red State Gold can contact me at the telephone number provided using autodialed/auto-selected, AI technology, artificial voice and prerecorded calls or text/SMS messages with marketing offers. Msg. and data rates apply. Your consent to such contact is not required for purchase. We respect your privacy.