Market Watch: The AI Bubble Is Propping Up the U.S. Economy

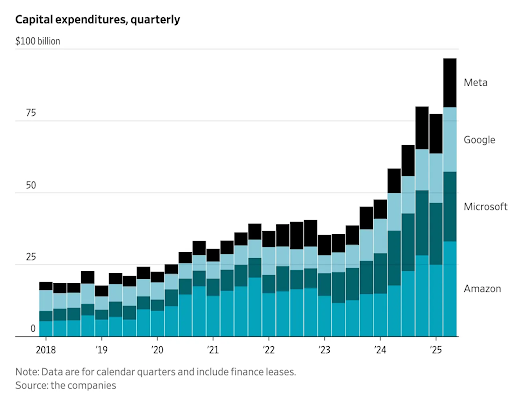

During the first half of 2025, one sector stood out as the driving force behind U.S. economic growth: artificial intelligence. Spending on AI infrastructure and technology contributed more to GDP growth than all consumer spending combined, accounting for roughly

1.3% of the total 3% growth rate.

And consumers are still spending. In fact, consumer spending hit historic highs, reaching $16.29 trillion in Q1 and $16.35 trillion in Q2, the highest levels ever recorded.

The real story is what’s happening in the stock market. 2018 was the first time in history a company received a $1 trillion dollar market cap valuation; that company was Apple. Now, just 7 years later, there are 9 companies that are valued over $1 trillion dollars in market capitalization.

- Nvidia: $4.301T

- Microsoft: $3.723T

- Apple: $3.365T

- Alphabet: $2.894T

- Amazon: $2.454T

- Meta Platforms: $1.898T

- Broadcom: $1.712T

- TSMC: $1.351T

- Tesla: $1.132T

Together, these nine tech giants are worth an astonishing $22.83 trillion, making up more than 34% of the entire U.S. stock market’s $66 trillion total market cap. This level of concentration means the health of the U.S. economy is closely tied to the performance of a handful of AI-driven companies.

If the AI boom slows, whether because of waning investor enthusiasm, declining profitability, or new regulations, the impact could ripple across the entire economy.

RSG Market Watch Takeaway

When so much market growth depends on a single sector or a handful of companies, smart investors look to diversify. Gold and silver have historically served as a store of value during periods of economic uncertainty, inflation, and market volatility. Adding physical precious metals to your portfolio can help safeguard your wealth, hedge against risk, and create a stronger foundation for long-term growth.

Blood in the Machine –The AI Bubble is So Big it’s Propping Up the US Economy; AI investment acting as private-sector stimulus.

InvestingLive –US Economy on the Verge of a Recession Says Moody’s Chief Economist; Fed unlikely to prevent downturn.

Business Insider –Top Economist Warns the U.S. is ‘on the Precipice of Recession’; Fed’s ability to rescue limited.

Fox Business –Moody’s Economist Warns U.S. Economy on Brink of Recession; leading indicators point to slowdown.