Silver may be cheaper than gold but don’t mistake its price for lack of power. This overlooked metal has both monetary roots and industrial muscle. It's the only asset class with one foot in the financial world and the other in the future of global technology.

In a time of inflation, green energy expansion, and market uncertainty, silver is where value and opportunity collide.

Why Smart Investors Are Turning to Silver

Dual Demand: Wealth + Industry

Unlike gold, silver is both an investment metal and a critical industrial commodity. It powers:

- Solar panels

- Electric vehicles

- Medical instruments

- 5G networks

- Semiconductors

- Water purification systems

This dual demand fuels both stability and long-term growth. As clean energy mandates ramp up globally, silver’s role becomes indispensable.

- Industrial demand for silver hit a record 654.4 million ounces in 2023, driven largely by solar tech and EV production (Silver Institute).

Affordable Entry Point

At under $40/oz, silver is significantly more accessible than gold. That makes it a perfect vehicle for:

- First-time investors

- Younger buyers

- Portfolio diversification on a budget

You don’t need a six-figure portfolio to take a meaningful position in silver, just foresight.

“Silver is gold’s little brother with a bigger upside.” – Anonymous Wall Street Trader

Explosive Upside Potential

Silver’s smaller market size means it moves faster when demand spikes. Historically, silver outperforms gold in bull markets:

- In the 2010 precious metals rally, gold gained ~130%, but silver exploded over

400%, peaking near $50/oz.

- In 2025, silver has already climbed

46% over five years, outpacing the Nasdaq (MarketWatch).

Volatility? Yes. But it’s the kind that works in your favor when positioned correctly.

Technological Utility & Future Demand

Silver is the metal of progress. Its usage is surging as the world transitions to:

- Renewable energy (solar, wind)

- Smart grid tech

- Battery storage systems

- High-speed data networks

Silver demand from solar panel manufacturers alone is expected to grow 85% by 2030 (IEA Report, 2024).

And with EV adoption exploding, silver is now embedded in every major automaker’s growth plan.

Privacy & Portability

Just like gold, silver offers off-the-grid ownership. It’s tangible, untraceable, and secure. You can store it privately, sell it worldwide, and maintain full control. No third-party, no digital risk, no financial surveillance.

In a digital world, silver remains a sovereign form of wealth.

The Coming Supply Crunch

Here’s what the media isn’t talking about: we’re running out of silver.

- The

global silver deficit hit 148 million ounces in 2024. The largest in over a decade (MarketWatch).

- Many silver mines are aging, and

new development is lagging behind demand.

- Governments are prioritizing silver for infrastructure and energy, limiting retail supply.

Low supply + high demand = breakout prices.

The Silver Double Play: Protection + Performance

Silver isn’t just a hedge against inflation or a safe haven in market crashes.

It’s also a driver of the modern economy. It moves with innovation and protects against uncertainty.

- It’s defensive: Protects wealth like gold

- It’s offensive: Amplifies returns in bull markets

“Silver is the bridge between old-world money and new-world technology.”

Why Now?

The timing has never been better:

- ESG mandates and clean energy funding are accelerating silver demand.

- The gold-to-silver ratio (historically ~60:1) still sits around

90:1, suggesting silver is dramatically undervalued (GoldSilver.com).

A reversion to the historical average could mean

silver outperforms gold by over 50% in the next cycle.

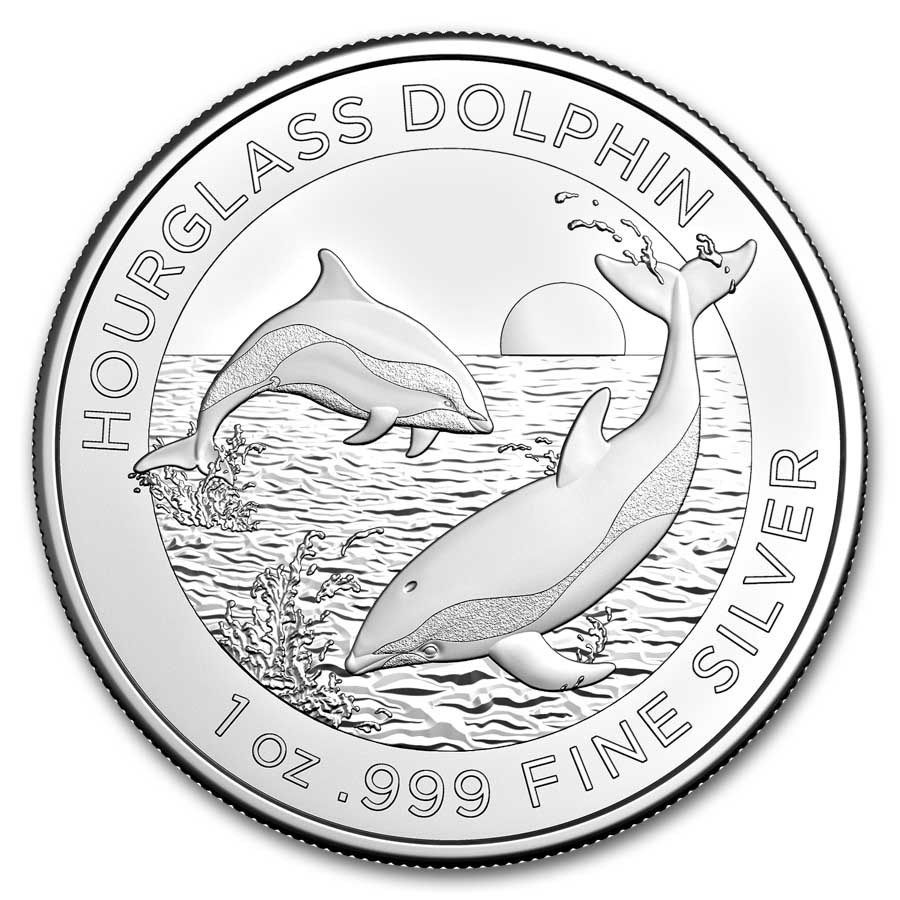

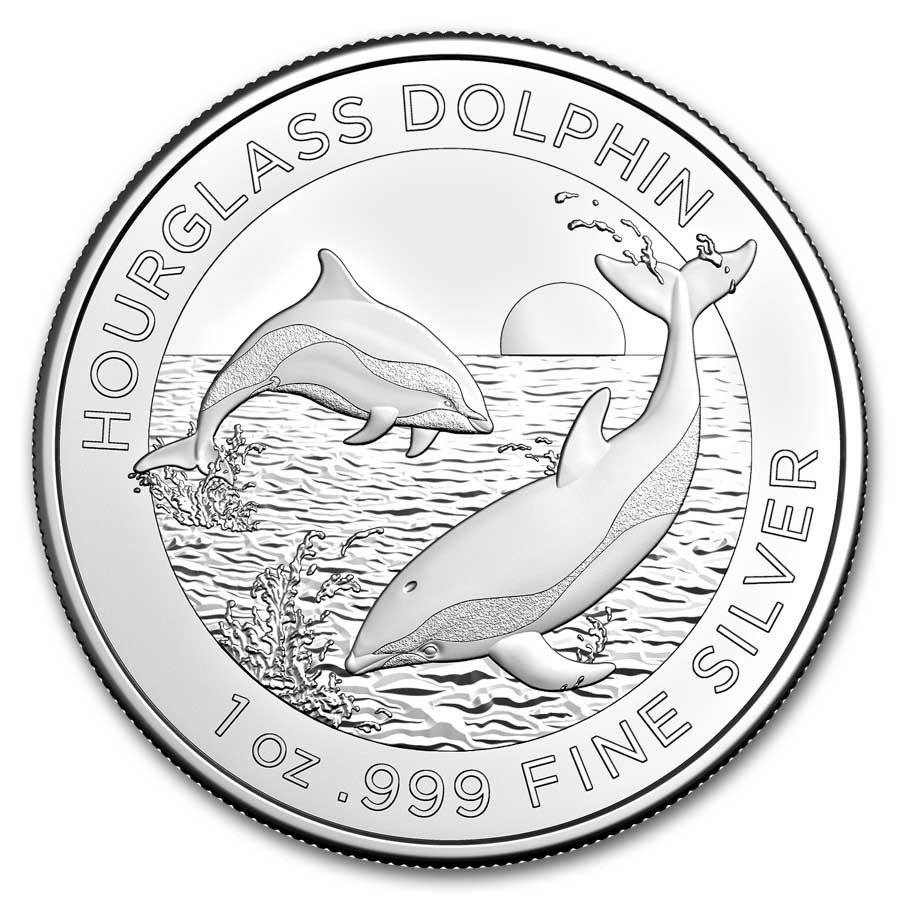

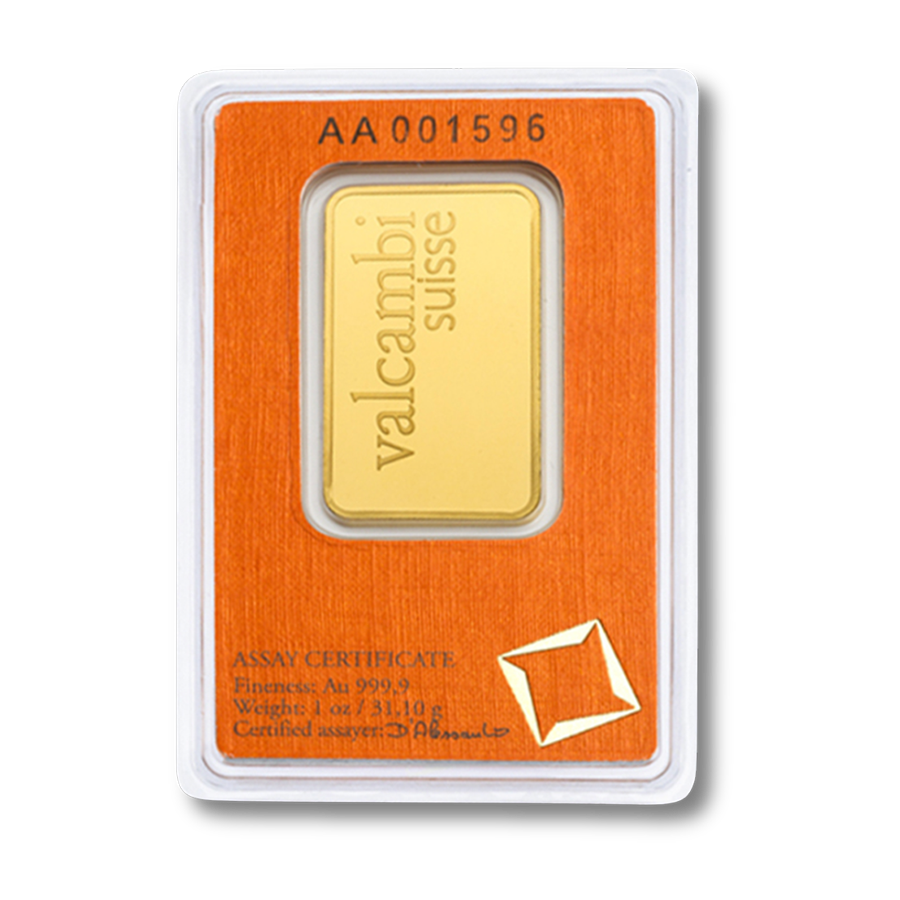

Silver in Your IRA

Want the growth potential of silver with the tax advantages of retirement savings?

You can hold physical silver bars and coins inside a self-directed IRA, just like gold.

At Red State Gold Group, we make the process easy:

- Full IRS compliance

- Secure, approved storage

- End-to-end assistance with paperwork and rollover

Your silver is real, allocated, and 100% in your name. Not a paper promise.

Final Word: Silver Is Undervalued, Overdue & Unstoppable

In a world driven by clean energy, technology, and inflation-resistant assets, silver is positioned to dominate. It’s more than a metal, it’s the most strategic asset of the next decade.

Don't wait until it's $50/oz again.

WHY SILVER?

The Affordable Powerhouse of Wealth, Technology & Upside

GET YOUR FREE ULTIMATE WEALTH SURVIVAL KIT

By submitting this form, I agree that Red State Gold can contact me at the telephone number provided using autodialed/auto-selected, AI technology, artificial voice and prerecorded calls or text/SMS messages with marketing offers. Msg. and data rates apply. Your consent to such contact is not required for purchase. We respect your privacy.