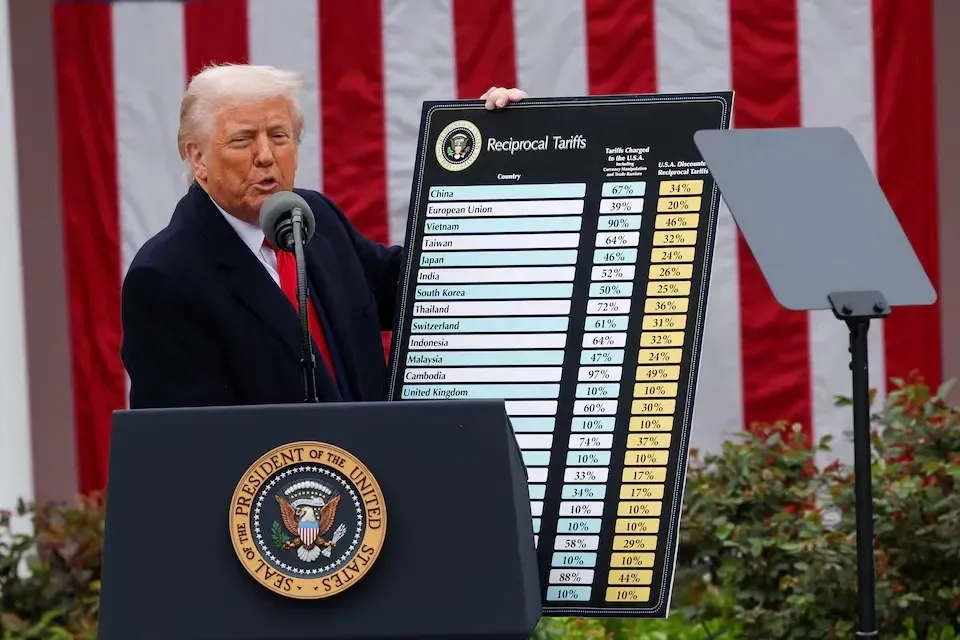

Tariff Turmoil Pushes Gold to Record Highs — A Wake-Up Call for Diversified Investors

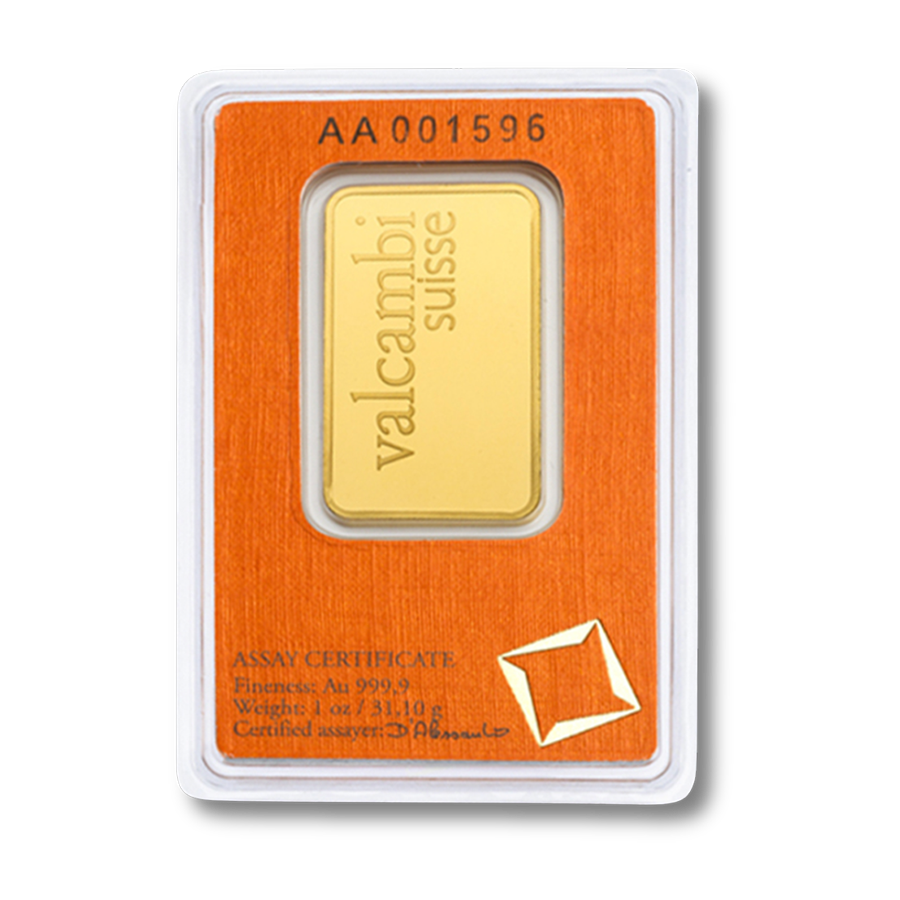

U.S. Government Imposes Tariffs on Swiss Gold Bars

In a move that caught global markets off guard, the U.S. government has ruled that one-kilogram and 100-ounce gold bars imported from Switzerland will now face steep tariffs. Switzerland, the world’s leading gold refiner, converts large London 400-ounce bars into smaller formats favored by U.S. futures traders. This sudden change has disrupted supply chains, widened the gap between New York futures and London spot prices, and driven December gold futures to an all-time high of $3,534 per ounce.

As Barron’s reports:

“The tariff, which applies to 1-kilogram and 100-ounce bars, could upend the supply chain that feeds the U.S. futures market.”

While the ruling directly targets a specific bullion format, its ripple effects extend across the gold market, serving as a stark reminder that government policy, geopolitical tensions, and economic uncertainty can reshape markets overnight.

Why This Matters for Your Portfolio

Gold’s rally has been fueled by more than tariffs alone. Barron’s notes:

“Gold futures settled at $3,534.20 an ounce, surpassing the previous high set earlier this week.”

Key drivers include:

- Safe-haven demand amid intensifying geopolitical risk and global economic concerns.

- Potential Federal Reserve rate cuts, reducing the opportunity cost of holding gold.

- Central bank interest, particularly from nations seeking to diversify away from the U.S. dollar.

Diversification in Action

This market moment underscores why diversification isn’t just a talking point, it’s a defensive strategy. Holding physical gold and silver alongside stocks, bonds, and real estate can:

- Reduce exposure to sudden policy changes.

- Protect purchasing power during inflationary periods.

- Offer liquidity and stability in times of currency volatility.

The Takeaway

From tariff shocks to monetary policy shifts, recent events reinforce a timeless truth: precious metals are a critical component of a resilient portfolio. In today’s interconnected, fast-moving markets, diversification with gold and silver isn’t just prudent, it’s essential to long-term wealth preservation.

Source:

Barron’s. Gold Bulls Hope to Ride Tariff Turmoil to New Highs. They Could Be Right. 8 Aug. 2025.