Gold Rallies on Tariff Threats: What It Means for Investors

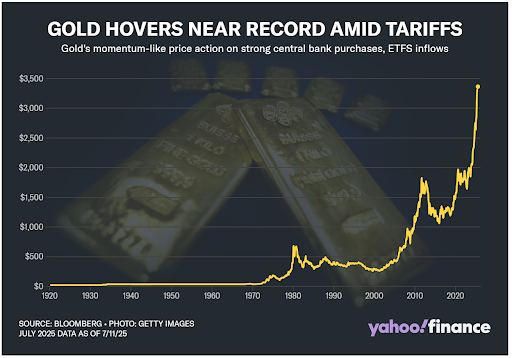

Gold prices have surged in response to rising geopolitical and trade tensions, reinforcing the metal’s reputation as a reliable safe haven during periods of uncertainty. As new tariffs and policy risks emerge, investors are once again turning to gold and silver to protect their wealth.

Key Highlights

- Gold recently hit a three-week high following a fresh round of U.S. tariff announcements. Spot gold climbed to $3,354.83/oz, while futures rose to $3,371/oz¹.

- Analysts note that safe-haven demand continues to drive upward momentum. OANDA strategist Kelvin Wong stated that a sustained daily close above $3,360 could set the stage for a rally toward $3,435/oz¹.

- The U.S. dollar index rose 0.1%, slightly limiting gold’s gains, though long-term fundamentals remain supportive¹.

- Silver gained 1.2% to $38.82/oz, outpacing gold in percentage terms. Platinum fell 1.3%, while palladium rose 0.2%¹.

Why This Matters for Precious Metals Investors

- Trade and Geopolitical Risks Fuel Demand

Policy shocks like tariffs continue to be key drivers of safe-haven flows into gold and silver. - Key Technical Levels Suggest Further Upside

A confirmed close above $3,360 may indicate bullish continuation, potentially triggering a move toward $3,435. - Silver Shows Relative Strength

With strong demand from both industrial and investment sectors, silver remains an essential part of a diversified metals portfolio.

Red State Gold Group Insight

- Monitor headlines — geopolitical and fiscal risks continue to influence metals markets.

- Use technical indicators, such as resistance breakouts, to help guide your entry points.

- Don’t overlook silver, which is showing strong relative performance and long-term upside potential.

Final Thoughts

As the global landscape shifts, physical precious metals continue to shine as a store of value and shield against instability. Gold’s recent surge amid renewed trade tensions serves as a reminder of the importance of real assets in any wealth preservation strategy.

Contact Red State Gold Group today to speak with a Precious Metals Specialist and learn how to position your portfolio for strength and security.

Source

Reuters – Gold prices scale three-week peak as Trump widens trade war