Brace For Crash And Trillions Wiped Out With Fed Rate Cut

Brace For Crash And Trillions Wiped Out With Fed Rate Cut

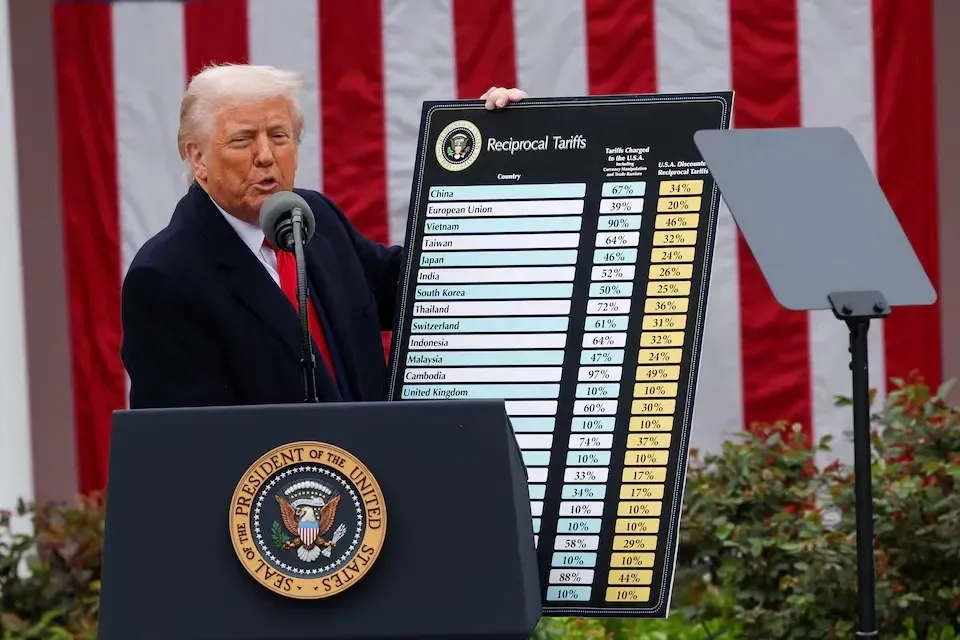

According to Forbes, researchers are currently estimating a 60% probability of a 50 basis point (bps) rate cut by the Federal Reserve. However, they suggest that a 25 bps cut is more likely, raising concerns about potential market volatility. If the Fed chooses a smaller cut without reassuring comments from Chair Powell, significant market declines could follow, potentially exceeding the $2 trillion drop seen in early August. High-growth stocks like Nvidia may experience 10-20% declines, while small-cap stocks could be particularly vulnerable due to their reliance on short-term financing. Additionally, negative jobless claims and stagnant inflation may heighten recession fears among investors. Last month, the S&P 500 saw significant volatility, with major declines in tech stocks contributing to an overall challenging market environment. Given these uncertainties, diversification into precious metals may be of interest to investors seeking a hedge against inflation and market fluctuations.

To Read More : https://www.forbes.com/sites/greatspeculations/2024/09/17/brace-for-crash-and-trillions-wiped-out-with-fed-rate-cut/

To Read More : https://www.forbes.com/sites/greatspeculations/2024/09/17/brace-for-crash-and-trillions-wiped-out-with-fed-rate-cut/