Wall Street’s Outlook: Lower Stock Returns Ahead and What It Means for Investors

For decades, U.S. stocks have delivered average annual returns of around 10%. But leading forecasters warn those days may be over.

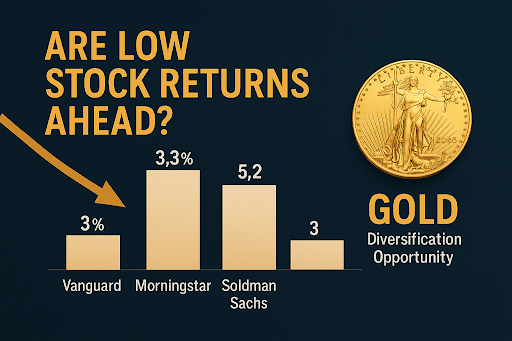

Recent forecasts paint a stark picture:

- Vanguard expects just

3.3% to 5.3% annual returns over the next decade.

- Morningstar predicts

5.2% per year.

- Goldman Sachs sees only

3% annually for the S&P 500.

A Morningstar roundup found no projection higher than 6.7% for domestic stock returns in the next 10 years. Even short-term forecasts suggest only meager gains for the remainder of the year.

Why Analysts Are Bearish on the Next Decade

1. Stocks Are Overpriced

The

CAPE ratio for the S&P 500 sits at

38.7—more than double the post–World War II average. The last two times valuations were this high (1929 and 1999), the market experienced prolonged declines.

“Right now, the U.S. stock market is trading at more than double the post–World War II average price-to-earnings ratio.” — Randy Bruns, CFP

2. The Buy-High Mentality

Despite high valuations, investors keep buying—encouraged by headlines about record highs and the belief that stocks “always go up” over time.

“Stocks are one of the few things people don’t like to buy on sale.” — Todd Schlanger, Vanguard

3. Market Concentration Risk

The

Magnificent Seven—Apple, Microsoft, Nvidia, Amazon, Alphabet, Meta, and Tesla—now make up

34% of the S&P 500’s value, compared to just 12% in 2015. Heavy reliance on a handful of stocks increases vulnerability if those companies stumble.

Why Precious Metals Deserve Attention

With forecasts calling for historically low returns, overvaluation risk, and concentration concerns, gold and silver offer an attractive counterbalance:

- Diversification – Low correlation with stocks reduces overall portfolio risk.

- Inflation Hedge – Preserves purchasing power in a lower-return, higher-cost environment.

- Crisis Protection – Historically strong performance during equity downturns.

Final Takeaway:

If the next decade delivers sub-6% stock returns, investors who diversify into tangible assets like gold and silver will be better positioned to protect and grow their wealth—regardless of equity market headwinds.

Source:

USAToday. Forecasts predict a dismal decade for stocks. Here's what to do. 3 Aug 2025