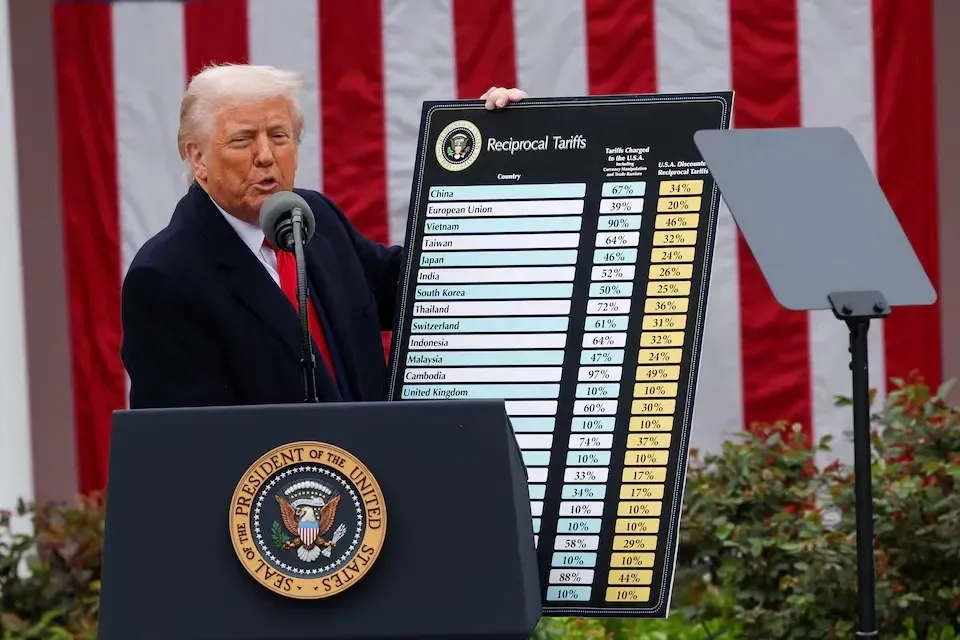

Inflation Shock Revives Stagflation Fears

July’s Producer Price Index (PPI) jumped 0.9% month-over-month and 3.3% year-over-year, far exceeding forecasts and marking the biggest increase in over three years. Core PPI also surged, underscoring that both goods and services costs are rising more broadly. The spike has reignited inflation concerns and complicated the Federal Reserve’s path on interest rate cuts, with some analysts suggesting cuts may now be delayed.

But what’s more significant is the shift in investor sentiment:

- Stagflation Expectations: According to

BofA Global Research,

70% of global investors now expect stagflation, sluggish growth paired with persistent inflation, over the next 12 months.

- Treasury Strain: Long-dated U.S. Treasuries, once the bedrock of portfolio stability, are delivering

negative total returns this year. Rising price pressures erode their appeal and leave bondholders anxious.

- The Gold Trade: In contrast, gold continues climbing, cementing its role as a favored stagflation hedge. Many advisors are encouraging clients to reduce reliance on Treasuries and pivot into hard assets that can both preserve principal and outpace inflation.

The Takeaway

With inflation running hotter than expected and growth slowing, the probability of stagflation is rising sharply. Investors are losing confidence in Treasuries as a “safe” option, turning instead to gold as a time-tested store of value. For those seeking stability and protection in an uncertain environment, diversifying into precious metals remains one of the most prudent strategies available.

To Continue Reading:

https://www.foxbusiness.com/economy/producer-prices-surged-more-than-expected-july-spurring-inflation-concerns?