Gold Rises to a New Record as Trump Embarks on China Trade War

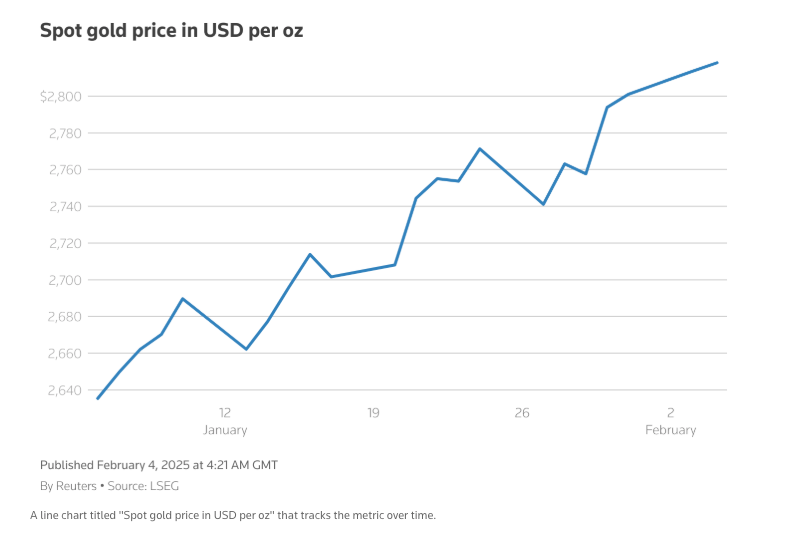

Gold prices have recently reached record highs, driven by a combination of geopolitical tensions and investor concerns over potential U.S. tariffs on China. On Tuesday, spot gold increased by 0.3% to $2,820.94 per ounce, following a record high of $2,830.49. U.S. gold futures, however, fell by 0.2% to $2,851.40.

The market's unease stems from U.S. President Trump's recent tariff announcements, which, despite a temporary suspension for Mexico and Canada, continue to raise concerns about trade relations with China. Analysts suggest that gold prices may remain elevated due to ongoing market volatility and policy uncertainties, with some predicting prices could approach the psychological $3,000 level.

Additionally, central banks from countries such as Poland, Turkey, India, and China have been significant buyers of gold, further supporting its price. Retail investors are also contributing to the demand, viewing gold as a safe haven amid economic and inflationary uncertainties. Despite a strengthening U.S. dollar, gold's appeal remains strong, and analysts expect prices could surpass $3,000 an ounce in 2025 due to geopolitical risks and potential changes in monetary policy.

To Read More : https://www.reuters.com/markets/commodities/gold-prices-hold-near-record-highs-us-tariff-concerns-linger-2025-02-04/

The market's unease stems from U.S. President Trump's recent tariff announcements, which, despite a temporary suspension for Mexico and Canada, continue to raise concerns about trade relations with China. Analysts suggest that gold prices may remain elevated due to ongoing market volatility and policy uncertainties, with some predicting prices could approach the psychological $3,000 level.

Additionally, central banks from countries such as Poland, Turkey, India, and China have been significant buyers of gold, further supporting its price. Retail investors are also contributing to the demand, viewing gold as a safe haven amid economic and inflationary uncertainties. Despite a strengthening U.S. dollar, gold's appeal remains strong, and analysts expect prices could surpass $3,000 an ounce in 2025 due to geopolitical risks and potential changes in monetary policy.

To Read More : https://www.reuters.com/markets/commodities/gold-prices-hold-near-record-highs-us-tariff-concerns-linger-2025-02-04/