Echoes of 1987: Dollar Moves, Fed Pressure, and Gold’s Rising Appeal

In a development catching the attention of seasoned market watchers, the U.S. Dollar Index (DXY) just posted its strongest weekly performance since October 2022, an unexpected reversal after nearly an 11% decline earlier this year.

As Morningstar/MarketWatch’s Mark Hulbert notes:

“This past week has been strong for the U.S. Dollar Index (DXY)—its best since October 2022, in fact.”

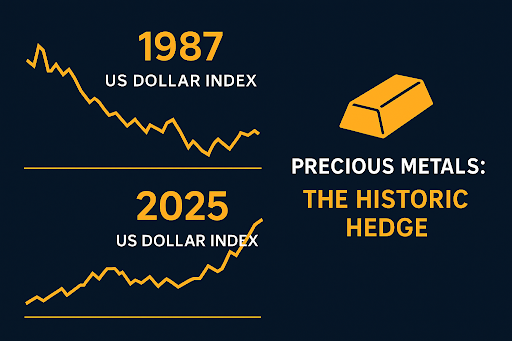

While a strengthening dollar might seem like a sign of economic resilience, history offers a cautionary tale. In the months leading up to the October 1987 stock market crash, known as “Black Monday”, the dollar experienced sharp swings, fueled in part by political pressure on the Federal Reserve to lower interest rates. That same pattern is now reemerging.

Why It Matters

Today, political influence over monetary policy is again in the spotlight. Calls for the Fed to cut rates, potentially weakening the dollar in the long run, could create similar pre-crash conditions. Hulbert stresses that a weakening dollar doesn’t directly cause crashes, but the combination of currency volatility and political pressure on the Fed has historically been a red flag for market stability.

Precious Metals Connection

For investors, this environment underscores why gold and silver remain essential portfolio hedges:

- Currency Hedge – Precious metals tend to hold or gain value when the dollar weakens.

- Crisis Insurance – Historical precedent shows gold often outperforms during periods of market stress.

- Diversification Tool – Metals move independently of stocks and bonds, offering balance when volatility spikes.

Final Takeaway

History doesn’t repeat itself exactly, but it often rhymes. The parallels between 1987 and today’s market conditions are a timely reminder to fortify portfolios with tangible assets that are insulated from currency and political risk. Allocating even a modest portion to physical gold and silver can help preserve wealth in unpredictable markets.

Source:

Mark Hulbert.

Trump and the Dollar Are Doing Something We Saw Just Before the October 1987 Stock Market Crash. Morningstar/MarketWatch, 2 Aug 2025.